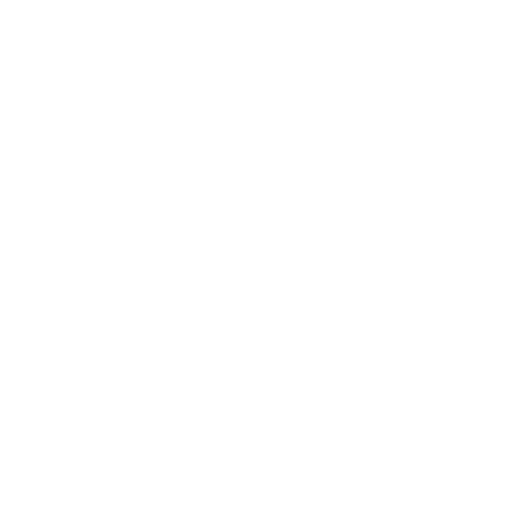

| 2025/06 - 中期 | 2024/12 | 2023/12 | 2022/12 | 2021/12 | 盈利能力分析 |

| 淨資產收益率 ROE (%) | 783.602 | -136.413 | -67.644 | -25.593 | -90.130 |

| 總資產報酬率 ROA (%) | -2.634 | -4.051 | -4.686 | -2.413 | -16.770 |

| 投入資產回報率 ROIC (%) | -3.769 | -5.582 | -6.229 | -3.201 | -21.499 | 邊際利潤分析 |

| 銷售毛利率 (%) | 7.089 | 9.355 | 14.424 | 21.478 | 10.809 |

| 營業利潤率 (%) | -12.978 | -11.062 | -12.545 | -7.960 | -35.208 |

| 息稅前利潤/營業總收入 (%) | -12.332 | -7.126 | -8.911 | -4.571 | -40.083 |

| 淨利潤/營業總收入 (%) | -14.104 | -9.336 | -11.150 | -5.565 | -41.309 | 收益指標分析 |

| 經營活動淨收益/利潤總額(%) | 96.277 | 114.053 | 60.091 | -25.694 | 25.954 |

| 價值變動淨收益/利潤總額(%) | 0.149 | 1.003 | -3.619 | 21.508 | 15.788 |

| 營業外收支淨額/利潤總額(%) | 18.603 | -4.121 | 1.426 | -8.139 | 18.396 | 償債能力分析 |

| 流動比率 (X) | 0.485 | 0.475 | 0.553 | 0.732 | 0.749 |

| 速動比率 (X) | 0.381 | 0.373 | 0.442 | 0.609 | 0.648 |

| 資產負債率 (%) | 101.358 | 98.519 | 94.435 | 90.590 | 88.365 |

| 帶息債務/全部投入資本 (%) | 96.103 | 92.236 | 67.365 | 67.153 | 65.533 |

| 股東權益/帶息債務 (%) | -2.482 | 1.539 | 9.740 | 17.142 | 20.472 |

| 股東權益/負債合計 (%) | -1.645 | 1.007 | 5.227 | 9.559 | 11.464 |

| 利息保障倍數 (X) | -3.415 | -2.037 | -2.335 | -1.639 | -13.091 | 營運能力分析 |

| 應收賬款周轉天數 (天) | 115.670 | 107.538 | 122.561 | 127.783 | 123.426 |

| 存貨周轉天數 (天) | 90.260 | 75.451 | 79.054 | 81.484 | 67.591 |

| 備註: | 報價延遲最少15分鐘,資料更新時間為 05/09/2025 16:30 |